REIMBURSEMENT OF TICPE (diesel fuel)

New reimbursement rates for road transportation published

The Taxe Intérieure de Consommation sur les Produits Energétiques (TICPE) targets a certain number of energy products, in particular fuels, hydrocarbons or petroleum products. The TICPE only applies to such products if they are used for fuel purposes. However, in the transport sector, refunds of TICPE paid on diesel fuel may apply.

The TICPE is regulated at the European level by Directive 2003/96/EC, and was initially set out in Articles 265 et seq. of the French Customs Code. These articles set out the general rules for the TICPE as well as the specific features of its pricing, particularly in relation to certain products or the use made of it.

Specific excise rates for road transport

Road transport, formerly covered by Articles 265 sexies et seq. of the Customs Code, benefits from a specific pricing system. Vehicles can fill up at full-rate stations and then apply for a partial refund of the TICPE on diesel fuel. To be eligible, diesel fuel must be consumed by road vehicles that meet a number of legal requirements, such as European vehicle registration.

As you know, the TICPE applicable to transporters has been recoded on January1, 2022. This new Code of Taxation of Goods and Services (CIBS) is part of the progressive transfer of competences from the customs administration to the tax administration in terms of management and collection of domestic consumption taxes.

Excise tax refund on diesel fuel under the CIBS

Articles L312-49 to -58 of the CIBS now contain the substance of the provisions of the Customs Code.

It should be noted that, to this extent, the TICPE reimbursement rights opened for the period prior to the recodification are still covered by articles 265 sexies and following of the Customs Code.

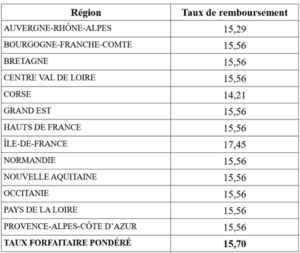

Attention: On a practical level, the amount of partial TICPE refunds also depends on the regions of France in which road vehicles are supplied with diesel fuel.

In order to obtain a refund, it is therefore necessary to apply a refund rate regularly updated by the customs administration to the quantities of diesel consumed by each eligible vehicle and purchased at full excise duty.

Publication of the new TICPE reimbursement rates applicable in the second half of 2022

For the second half of 2022, the French customs administration published on July 29, 2022 the tariffs applicable from July1 to December 31, 2022 for the road transport of goods:

Note: the weighted flat rate applies when a road vehicle is supplied in more than three regions of France.

Do you operate a road transport business in France and consume diesel fuel? You have a fleet of vehicles dedicated to your main activity other than transport? You don’t say TICPE but always TIPP! Contact FISCALEAD to check the eligibility of your vehicles for the application of reduced TICPE rates. We will carry out the procedures on your behalf with the competent customs services and obtain the refunds to which you are entitled.