VAT: rules on triangular sales

Is your company involved in triangular sales? Discover the rules that apply to triangular transactions:

- How are sales invoiced in triangular transactions?

- What rules apply to intra-Community VAT depending on the place of departure and destination?

Everything you need to know about how a triangular operation works

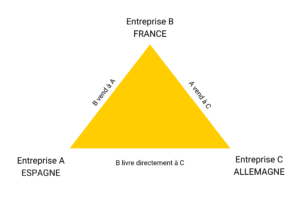

A triangular operation occurs when 3 separate companies, located in 3 different EU member states, are involved in the same physical flow of goods.

For example, a French company A may buy goods from a Spanish supplier B for resale to a German customer C. In this triangular operation, which is very common in industry, the company in France is considered to be an “intercalary” or “buyer/seller” company, since the goods are exported directly from Spain (supplier) to Germany (customer).

VAT rules for triangular sales

The Directive of December 16, 1991, simplified by the European Commission in 1992, stipulates that company B, the so-called “intercalary” company, cannot avoid value-added tax on triangular transactions: it is liable for VAT on triangular transactions.

However, a number of simplification measures have been introduced, framed and clarified as the VAT Directives have evolved.

In our example of a triangular operation, French company B would have to identify itself in either Spain or Germany.

A VAT expert to help you declare your sales, simplify your procedures and save time:

Make an appointment

Triangular operations: principles

Here are the basic rules for triangular operations:

- In the case of a triangular transaction, only one of the two sales is exempt.

- When French company B is identified in the country of departure of the goods, in this case Spain, it must communicate its Spanish intra-Community VAT number to its supplier A. Spanish supplier A will then be able to issue the sales invoice to French company A, including Spanish VAT, to be reclaimed according to the rules in force in Spain. Company A can then invoice its customer C in Germany. This second financial flow, considered as an intra-Community delivery, is thus exempt from VAT on departure from Spain. German company C will thus be invoiced exclusive of VAT using B’s Spanish number.

- When French company A is identified in the country of destination of the goods, in this case Germany, the reverse is true: the first financial flow, from Spanish supplier A to French intermediary B, will be exempt. Thus, B will have to provide its German VAT number to the Spanish supplier: the latter will invoice the French company B for the goods, exclusive of VAT, using the German intra-Community number and indicating Germany as the country of delivery. A will then invoice C VAT-inclusive with German VAT.

- When the French company A is identified in both countries, it must use the intra-Community VAT number it has in the country from which the goods originate (in this case, Spain, which is responsible for transporting the goods to Germany).

Triangular operations: simplifications

What if B is not identified for VAT purposes in either of the two member states? Article 141 of Directive 2006/112/EC of November 28, 2006 provides for simplified taxation of triangular transactions. Thanks to this directive, the intercalary company can avoid value-added tax on triangular transactions.

However, for these measures to be applicable, the 3 companies involved in the triangular operation must each be identified in their respective countries, and the buyer/seller company must not be identified in the country of departure and/or destination of the goods.

The simplification also applies when, in a triangular operation, the intercalary company is a non-EU company identified in a Member State that is neither the place of departure nor the place of delivery of the goods.

Would you like to know more about taxation on the transport and export of goods in a triangular operation? Fiscalead’s experts are on hand to explain everything you need to know about your obligations during a triangular operation: find out more about our services if you are subject to VAT.